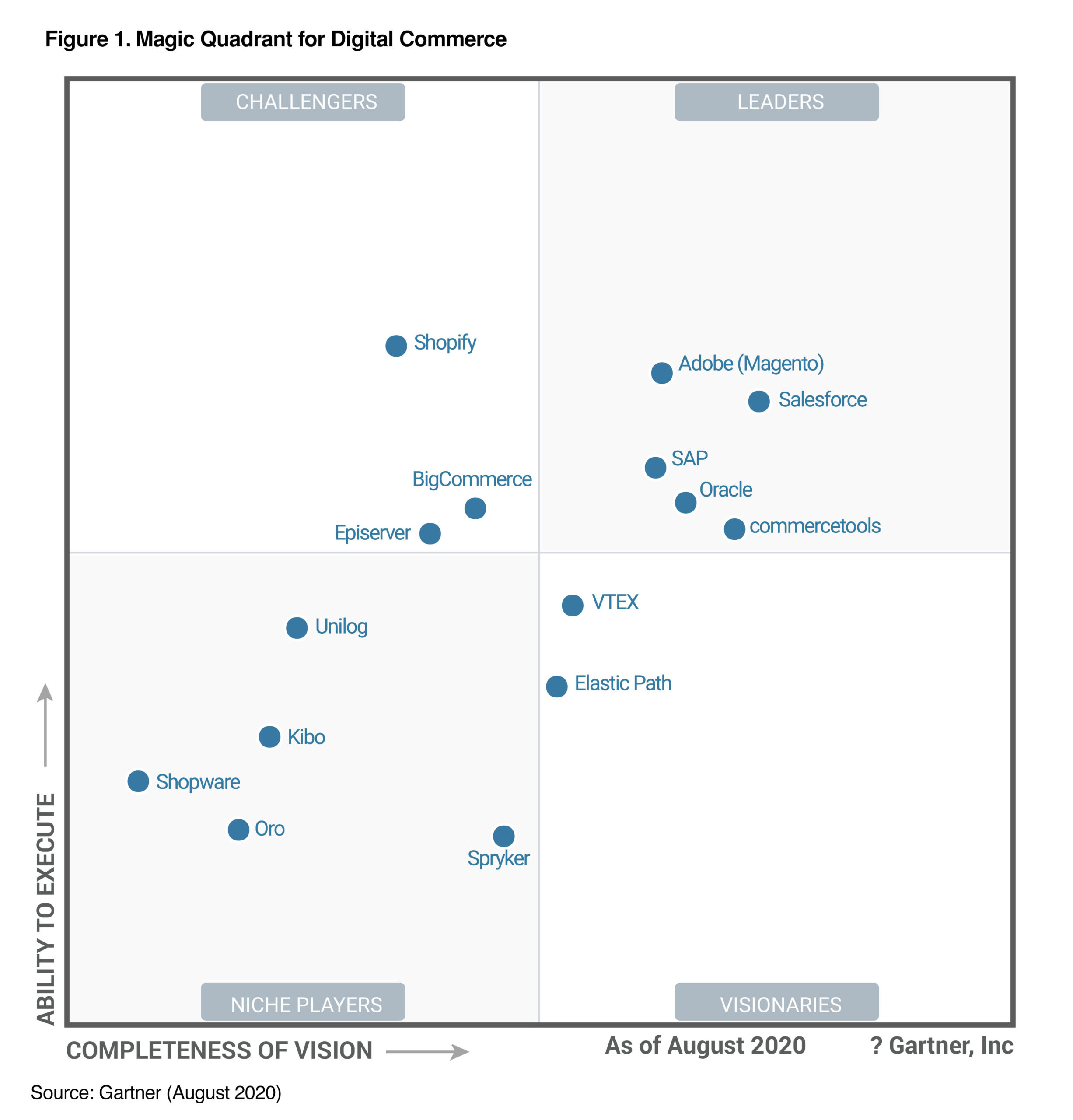

Kohl’s Shares Up as Investor Urges Business Split TipRanks data shows that financial blogger opinions are 83% Bullish on COUP, compared to a sector average of 67%. The average Coupa Software price target of $289.33 implies 66.19% upside potential to current levels. Overall, the stock has a Moderate Buy consensus rating based on 8 Buys and 9 Holds. Other factors include some disappointing metrics around Coupa Pay, and some concerns that Coupa’s competitive lead may be shrinking a bit, as suggested by a comparison of the 2021 Gartner Magic Quadrant to the one from 2020. The analyst lists several factors affecting Coupa’s performance including some macro headwinds in spend management, and some issues digesting acquisitions, especially LLamasoft. Walravens believes Coupa is a leader in the spend management business, but has had a challenging year from the stock’s perspective.

Responding to Coupa’s quarterly performance, JMP Securities analyst Patrick Walravens maintained a Hold rating on the stock. Meanwhile, Q4 earnings are projected to be between $0.03 per share and $0.05 per share, while the consensus estimate is a loss of 6 cents per share.įor the full year fiscal 2022, Coupa forecasts revenue and earnings to fall in the range of $717million to $718 million and $0.66 per share to $0.69 per share, respectively. See Analysts’ Top Stocks on TipRanks > Outlookīased on current business momentum, Coupa forecasts fourth-quarter revenue to be in the range of $185 million to $186 million, while the consensus estimate stands at $184.2 million. With the fourth quarter well underway, we continue to leverage our Value-as-a-Service approach to add strategic customers across many industries and of all sizes.” Management CommentsĬhairman and CEO at Coupa, Rob Bernshteyn, said, “As demonstrated by our third-quarter results, we are seeing strong adoption of the Coupa platform as our customers continue to prioritize Business Spend Management as a fundamental aspect of their go-forward strategy. The solid revenue growth was aided by a 40% year-over-year jump in Coupa’s Subscription revenue.Ĭompared to Q3FY21, Coupa’s quarterly billings rose 38% year-over-year to $193 million. Outstanding ResultsĬoupa reported adjusted earnings of $0.31 per share, up 72.2% year-over-year and 29 cents higher than analysts’ estimates of $0.02 per share.įurthermore, revenue came in at $185.81 million, a 40% growth compared to the year-ago period, outpacing analysts’ estimates of $178.34 million. However, following the news, shares fell 10.7% during the extended trading session on December 6. The company even guided for fourth-quarter revenue and earnings, which came in better than consensus estimates. ( COUP) reported outstanding third-quarter results, with earnings and revenue both beating estimates by a huge margin. Cloud-based business spending management platform Coupa Software, Inc.

0 kommentar(er)

0 kommentar(er)